OUR PRODUCTS

Algorithmic Strategy Engine

Alpha Atlas ships with statistically validated, rule-based “playbooks.” These strategies scan price, volume, and time structures to identify opportunities and generate entries, exits, position sizing, and stop rules. Signals execute at machine speed to reduce emotion and improve consistency.

Real-Time Market Data Integration

Our engine connects directly to real-time data streams and continuously refreshes model inputs. When price/volume/order-flow shifts, the system updates in milliseconds to capture fast windows—or cut risk—without delay.

NLP News & Sentiment Filtering

Alpha Atlas uses NLP to mine news, filings, research, and social feeds—pulling signal from noise. Events are tagged for type, sentiment, impact strength, and time-decay, then cross-checked against technical/quant inputs. 4) Backtesting & Research Tools Run multi-period, multi-asset, multi-parameter tests and Monte Carlo analysis to assess robustness across regimes: win rate, payoff ratio, max drawdown, Calmar ratio, equity curve behavior, and factor exposure.

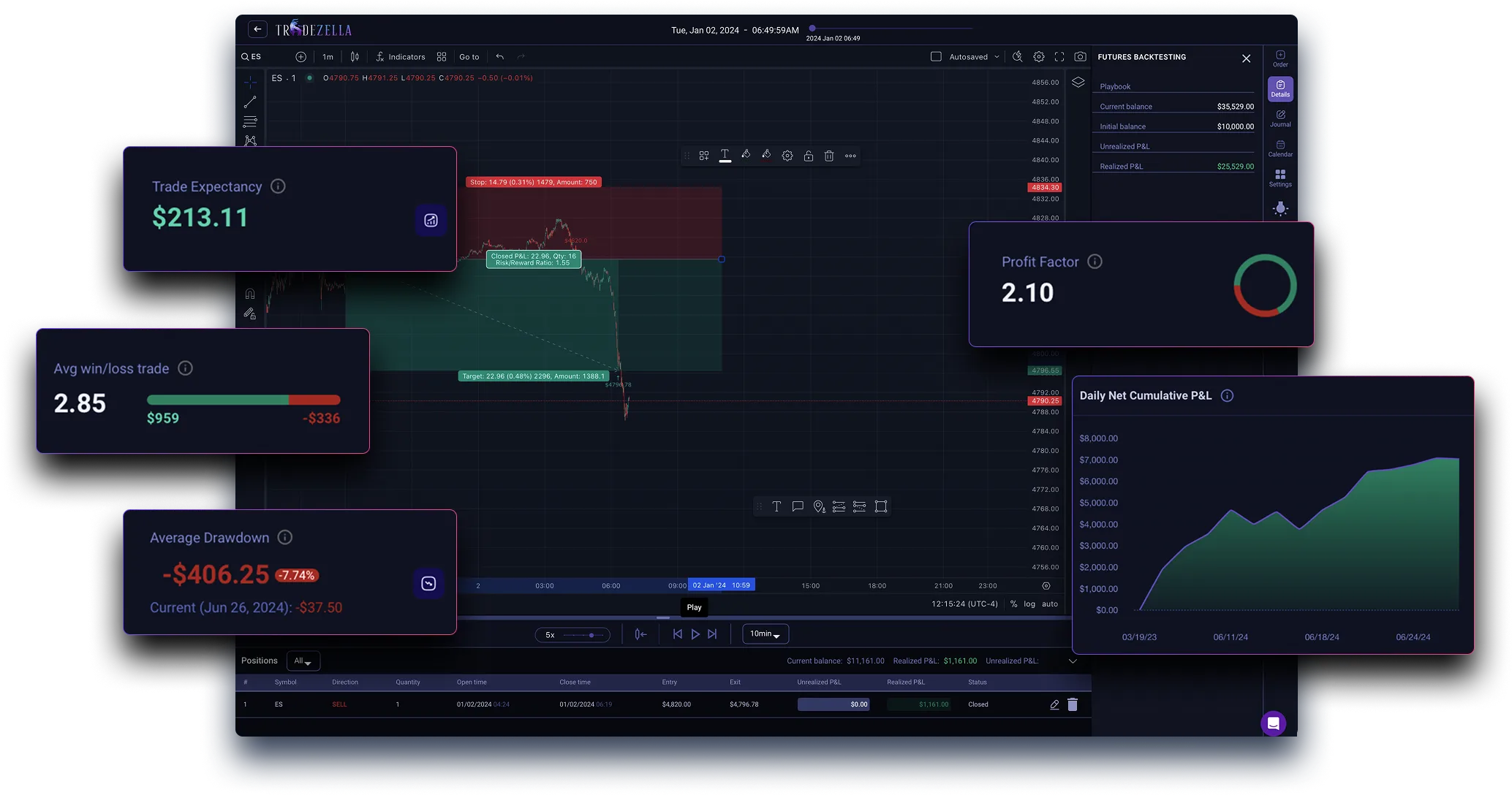

Backtesting & Research Tools

多Run multi-period, multi-asset, multi-parameter tests and Monte Carlo analysis to assess robustness across regimes: win rate, payoff ratio, max drawdown, Calmar ratio, equity curve behavior, and factor exposure.

Risk Management Protocols

Risk is a first-class citizen in Alpha Atlas: Tiered stops, volatility-based sizing, correlation-aware exposure control, tail-risk defenses, and hedge suggestions. The goal is to minimize irreversible losses and smooth the equity curve.

What members say

“Signals + risk context help me avoid low-quality trades.”

“Explainable AI matters. I can audit decisions and improve.”

“The API drops right into my Sheets & dashboards.”

Ready to see your edge?

Start a free trial or book a demo. Join our WhatsApp to discuss onboarding.